Get Wise, Avoid Traps

Are you having a hard time buying a car? Well, it's very likely to get a lot worse. As if shopping for a new car wasn't confusing enough, here come the shady dealers with all the jargon they love to throw at you. So, to make sure that you're armed with the right knowledge to avoid any sketchy deals, here's a breakdown of 20 crucial dealership terms that you need to know if you want to avoid getting scammed. Let's dive right into it!

1. Actual Cash Value (ACV)

This is the real value of your trade-in vehicle based on its condition. When you know the ACV, it can save you from getting a low-ball offer as you trade in your old car. So, always get an independent appraisal to make sure you know your car's true worth.

2. Addendum

An addendum is an additional sticker on the car that shows dealer-installed options and any price adjustments. It's important to check the addendum to see if the added options justify a higher price tag. Don't be afraid to ask for a detailed breakdown of these charges.

3. Manufacturer's Suggested Retail Price (MSRP)

Think of this as the "list price" set by the manufacturer. Almost nobody should pay the full MSRP because it is exactly what it says—a "suggested" price. In most cases, you can negotiate below this number, especially if you've done your homework on the dealer invoice price and current market conditions.

4. Additional Dealer Markup (ADM)

Also called "market adjustment," this is an extra fee dealers add above MSRP, especially on popular models or during high demand. It's usually listed on the addendum sticker. Don't assume these markups are mandatory—they're often negotiable, and some dealers don't charge them at all.

5. Annual Percentage Rate (APR)

APR is the interest rate on your car loan. It's important to shop around for the best APR to save money over the life of your loan. Even a small difference in the APR can add up to significant savings. That's why you need to compare offers from different lenders.

6. As-Is

A vehicle sold "as-is" comes with no warranty, meaning you take on all the risks of future repairs. Just be extra cautious with these deals because any issues that pop up post-purchase will be your responsibility. Also, have a trusted mechanic inspect the car before you commit.

7. F&I Products

These are add-on items the Finance & Insurance (F&I) department tries to sell you after you've agreed on the car price. It usually includes extended warranties, paint protection, or gap insurance. While some of these might be useful, many are high-profit items for the dealer. Don't feel pressured to buy them on the spot.

8. Balloon Payment

This is a sneaky one. It's a large final payment at the end of your loan term. The monthly payments might look attractively low, but you'll get hit with a big bill at the end. So, check if your loan has a balloon payment.

9. Buy Rate

This is the base interest rate that lenders offer to the dealership. Dealers can mark up this rate (usually capped at 2-3% by lenders) to make additional profit. That's why it's smart to get pre-approved for a loan before visiting the dealership—it gives you leverage to negotiate better loan terms.

10. Dealer Invoice

Think of this as the dealer's receipt from the manufacturer. It shows what the dealership paid for the car, but don't be fooled. Dealers often get additional incentives and holdbacks that aren't shown here. When you know the invoice price, it gives you a solid starting point for negotiations.

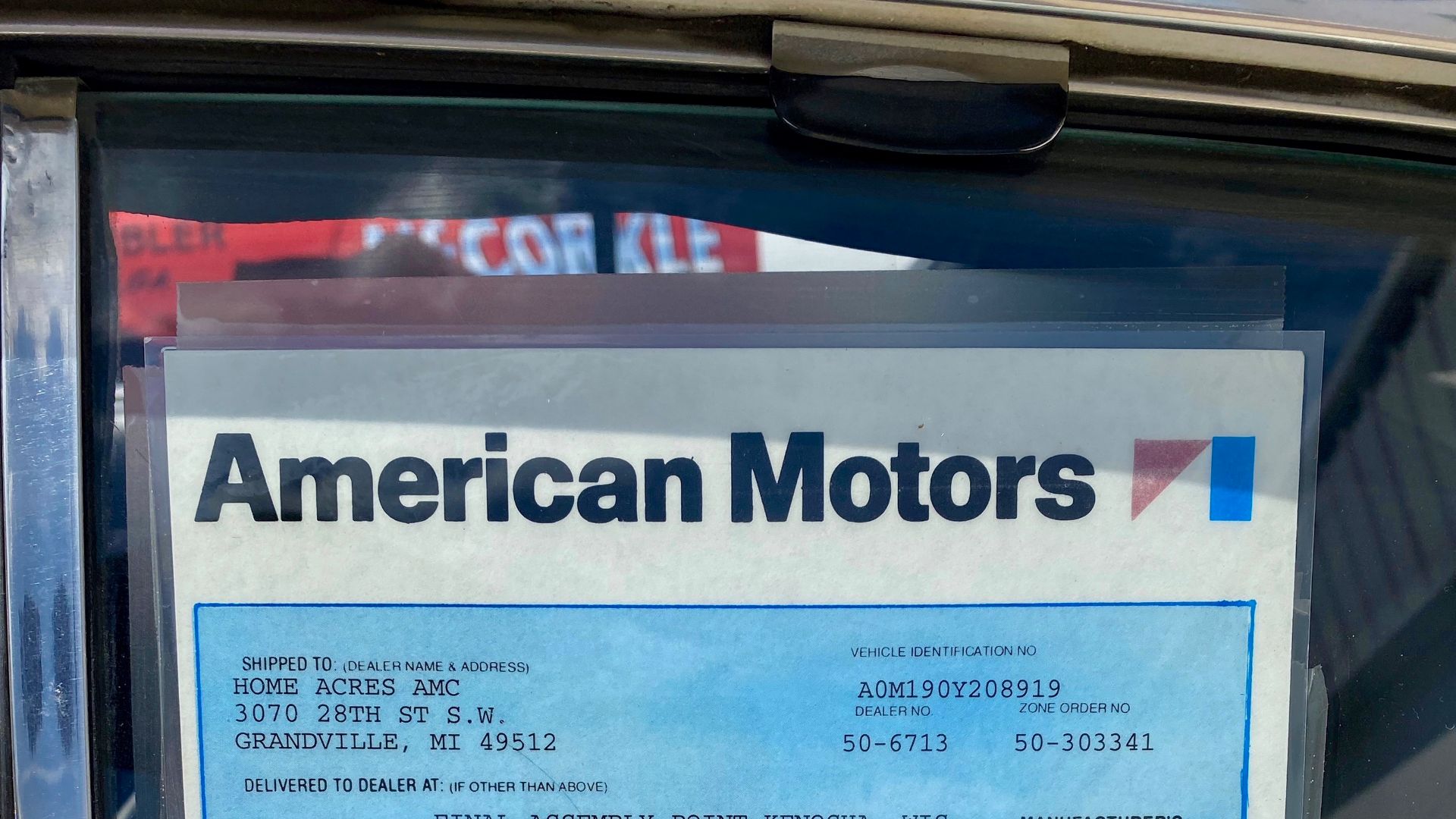

11. Monroney Sticker

This is the window sticker required by law on all new cars. It's your best friend at the dealership because it shows the real MSRP, standard features, fuel economy ratings, and safety scores. Pay special attention to any additional dealer markups or add-ons that weren't on the original Monroney sticker. Those are usually negotiable.

12. Destination Charge

It is the fee for getting the car from the factory to the dealership. While it's usually non-negotiable, watch out for dealers who try to add extra delivery fees on top of this. The destination charge should already be included in the Monroney sticker price.

13. Down Payment

Quite common, nothing unique—this is the money you pay upfront when buying a car. While 20% is traditionally recommended, you'll want to balance the down payment size against keeping an emergency fund. Be wary of dealers insisting on larger down payments for bad credit loans. This could indicate predatory lending practices.

14. Extended Warranty

An extended warranty can also be called as a service contract. This coverage kicks in after your manufacturer's warranty expires. Before buying one, check what's already covered by the manufacturer's warranty. Also, research the reliability of your chosen car model.

15. GAP Insurance

GAP means Guaranteed Asset Protection, and it covers the difference between what you owe and what your car is worth if it's totaled. It's worth considering if you're making a small down payment or have a long loan term. But don't automatically buy it from the dealer. Your regular insurance company might offer better rates.

16. Holdback

Holdback is the dealer's secret cushion—typically 2–3% of the MSRP that manufacturers pay back to dealers after a sale. However, dealers rarely discuss holdback. But now you know it exists. So, take advantage of your knowledge and understand why they might still profit even when selling "at invoice."

17. Lease Residual Value

This is what the dealer estimates your leased car will be worth after your lease ends. A higher residual value usually means lower monthly payments, but be careful. If you're planning to buy the car after the lease, a high residual value means you'll pay more to purchase it.

18. Rebates and Incentives

These are the sweet deals given by the manufacturers. They might come as cash back, special financing rates, or lease deals. Since some might be unadvertised, and others might be specific to certain groups like military personnel or recent graduates. Don't rely on the dealer to tell you about all available offers.

19. Title and Registration Fees

These are the government charges you can't dodge when buying a car. Every state has different fees for transferring the title to your name and getting your registration sorted. Even if those fees aren't negotiable, make sure the dealer isn't padding them with extra charges. Verify them against your state's DMV website.

20. Trade-In Value

This is what the dealer offers for your current car, and it's often less than what you'd get selling it privately. A smart move would be to get your car's value appraised at multiple places (like CarMax or online services) before heading to the dealer. This gives you solid comparison numbers and negotiating power.